Budget-friendly Family Pet Insurance Policy Plans for every single Family Pet Parent

Navigating the landscape of budget-friendly animal insurance plans is crucial for pet dog moms and dads intending to guard their fuzzy friends while handling prices. With a selection of choices readily available, from basic accident-only protection to more extensive strategies tailored to specific demands, comprehending the subtleties of each can make a significant difference in financial readiness. Factors such as premiums, deductibles, and copyright reputation additionally play a crucial duty in decision-making. As we check out these considerations, it ends up being clear that informed options are vital for guaranteeing both pet health and monetary security. What should be the following action in this crucial trip?

Recognizing Pet Dog Insurance Fundamentals

Recognizing the fundamentals of pet insurance coverage is vital for any pet dog proprietor seeking to safeguard their fuzzy buddies against unexpected medical expenses. Pet insurance is made to reduce the financial concern connected with veterinary treatment, specifically in emergencies or for persistent conditions. It runs similarly to health insurance coverage for human beings, with insurance holders paying a regular monthly premium for protection on numerous medical solutions.

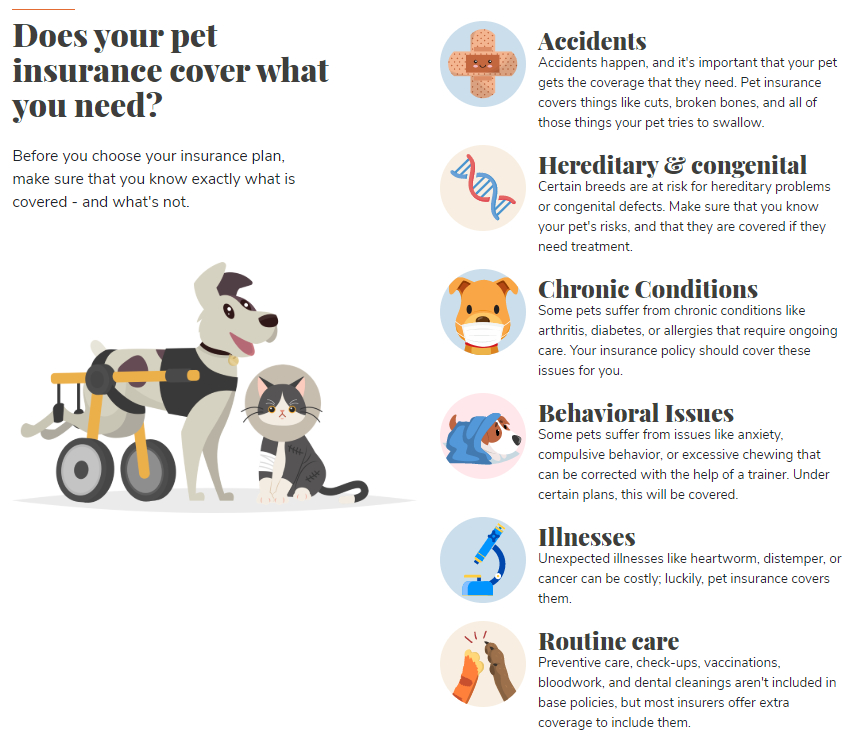

A lot of pet insurance coverage plans cover a variety of services, including accidents, diseases, and sometimes preventative care. It is essential for animal proprietors to be aware of policy exemptions, waiting periods, and protection limitations that may apply.

Kinds Of Animal Insurance Plans

Pet insurance strategies can be classified into several distinctive types, each made to meet the differing demands of family pet proprietors. One of the most typical kinds include accident-only plans, which cover injuries resulting from crashes however leave out health problems. These strategies are commonly more affordable and suitable for pet owners looking for standard security.

Extensive plans, on the other hand, offer more comprehensive protection by including both diseases and mishaps. This kind of plan is optimal for animal proprietors who want extensive protection for their pet dogs, covering a vast array of clinical problems, from small disorders to chronic conditions.

Another choice is a wellness or preventative treatment plan, which focuses on regular veterinary services such as vaccinations, oral cleansings, and annual check-ups. While these plans usually do not cover emergencies or health problems, they motivate aggressive health and wellness steps.

Finally, there are personalized strategies, permitting family pet owners to customize their protection based upon their family pet's particular demands. This versatility can help manage expenses while ensuring appropriate insurance coverage. Recognizing these kinds of family pet insurance policy strategies can equip animal proprietors to make educated decisions that line up with their economic and treatment priorities.

Variables Affecting Costs Expenses

The expense of pet dog insurance coverage premiums can vary dramatically based on a number of key variables. The pet dog's health background plays an essential duty; pre-existing conditions can lead to exclusions or raised rates.

An additional significant aspect is the level of coverage picked. Comprehensive prepares that include health care, preventative therapies, and greater reimbursement percentages typically include greater premiums contrasted to basic plans. In addition, the annual deductible chosen by the family pet proprietor can affect prices; lower deductibles typically result in higher month-to-month premiums.

Family pet parents in city areas might encounter greater premiums than those in rural setups. Comprehending these factors can aid pet dog proprietors make informed decisions when selecting an insurance plan that fits their spending plan and their animal's needs.

Contrasting Top Pet Insurance Coverage Providers

Countless family pet insurance policy carriers use a range of strategies, making it crucial for pet dog owners to contrast their choices very carefully. Trick gamers in the pet insurance policy market consist of Healthy and balanced click now Paws, Embrace, and Petplan, each presenting one-of-a-kind attributes that accommodate different demands.

Healthy Paws is understood for its detailed protection for accidents and diseases, without caps on payouts. Its concentrate on client service and fast insurance claims processing has gathered favorable comments from family pet owners. Alternatively, Embrace provides personalized plans, enabling pet proprietors to change deductibles and reimbursement degrees, which can lead to more economical premiums. In addition, Embrace has a wellness add-on that covers regular treatment, interesting those desiring preventative choices.

When contrasting carriers, pet proprietors should take into consideration factors such as protection limitations, exemptions, and the insurance claims procedure. By completely reviewing these aspects, family pet moms and dads can choose a plan that finest fits their medical and economic demands for their hairy friends.

Tips for Choosing the Right Plan

How can pet owners navigate the myriad of alternatives offered when selecting the right insurance coverage prepare for their fuzzy companions? To start, examine your animal's details demands based upon breed, age, and health and wellness learn the facts here now history. Older pet dogs or those with pre-existing conditions might call for more extensive insurance coverage, while more youthful pets may gain from standard strategies.

Next, compare the insurance coverage alternatives. Look for plans that include important solutions like regular examinations, inoculations, and emergency situation care - Insurance.

Reviewing customer evaluations and scores can give insight right into the supplier's dependability and consumer solution. Last but not least, think about the lifetime limits on claims, as some strategies cap payments every year or per problem (Insurance).

Final Thought

Finally, budget-friendly pet dog insurance policy strategies are vital for taking care of unforeseen vet costs while making certain ideal take care of pet dogs. A comprehensive understanding of the different sorts of protection, costs components, and alternatives readily available from leading providers considerably boosts the decision-making process for animal parents. By meticulously contrasting strategies and thinking about specific needs, family pet owners can secure reliable protection without straining their finances, consequently advertising the wellness of their cherished companions.

Browsing the landscape of inexpensive animal insurance policy plans is important for use this link pet moms and dads aiming to protect their fuzzy friends while managing costs.Family pet insurance coverage strategies can be categorized right into numerous unique types, each developed to fulfill the varying demands of pet dog owners. Understanding these kinds of family pet insurance policy strategies can equip animal owners to make educated choices that align with their economic and care priorities.

Comprehending these factors can aid pet owners make educated choices when picking an insurance policy strategy that fits their budget plan and their animal's demands.

In conclusion, economical pet insurance coverage plans are crucial for managing unforeseen veterinary costs while guaranteeing ideal treatment for family pets.